Although declaring charges are rather reduced, chauffeurs who need SR-22 insurance will locate that their prices are much more costly as a result of the DUI or other offense that brought about the SR-22 demand to begin with. Just how a lot does SR-22 price in The golden state? SR-22 insurance policy in California will certainly cost greater than what you formerly spent for vehicle insurance coverage, however this is mostly due to the violation that triggered you to need an SR-22 declaring.

Whether or not your current insurer will file an SR-22 for you, among the most basic methods to make certain you're obtaining the most affordable SR-22 coverage is to contrast quotes from multiple business. Many major insurance providers in California, consisting of Progressive and also Geico, will certainly file SR-22 kinds. Since every insurer examines your motoring history according to its very own standards, we advise contrasting at the very least three quotes to guarantee you're obtaining the most effective rates.

As an example, a vehicle driver with no-DUI background paying $100 monthly for automobile insurance policy might receive a 20% good vehicle driver discount rate and also only pay $80 monthly. After getting a DUI, the driver will be back to paying a minimum of $100 each month, which is 25% greater than the previous discount price.

Keep in mind that the SR-22 insurance coverage requires to provide all vehicles you have or on a regular basis drive. For how long do you need to have an SR-22? The length of time you'll need to maintain SR-22 relies on your conviction, which must mention how much time you're expected to maintain the SR-22 filing (division of motor vehicles).

Keeping continuous protection is very important - division of motor vehicles. Any kind of gaps in your SR-22 auto insurance coverage will certainly cause your driving opportunities to be put on hold once more, as your insurance company would file an SR-26 form with the DMV notifying them of the lapse. If you relocate out of California during your compulsory filing duration, you'll need to find an insurer that does company in both states and agrees to file the kind for you in the state.

Little Known Facts About What Is Sr22 Insurance? - Focus2move.

Throughout the one decade complying with a DRUNK DRIVING, you won't be eligible for a good chauffeur discount rate in The golden state. After this duration has actually expired, the DUI will be removed from your driving document as well as you will be eligible for the price cut once more. You may be able to get the conviction eliminated from your record previously, however as long as you stay with the same insurance firm, the company will certainly understand about the drunk driving and also remain to utilize it when identifying your SR-22 insurance coverage prices (sr-22).

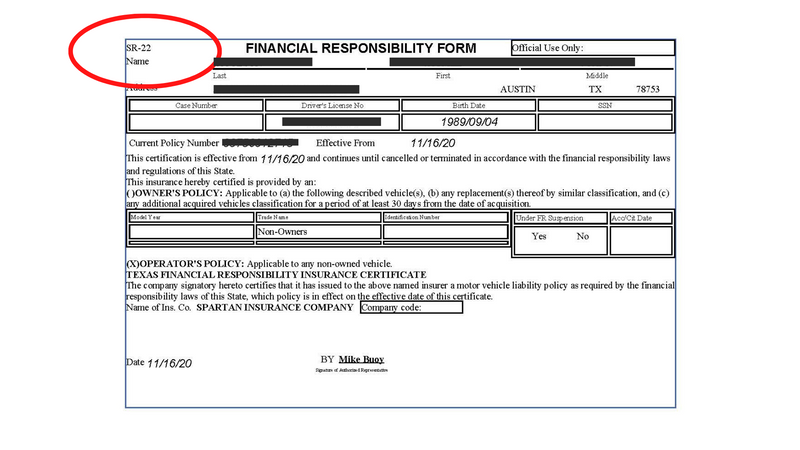

It supplies insurance coverage if you sometimes drive other people's autos with their consent. For those that don't possess a vehicle, non-owner SR-22 insurance policy is a policy that gives the state-required liability insurance policy but is linked to you as the vehicle driver, despite which lorry you make use of. One of the benefits of non-owner SR-22 insurance policy is that quotes are generally cheaper than for a proprietor's plan, because you'll only receive liability coverage as well as the insurer thinks you drive less frequently.

Methodology To establish the average rate of SR-22 insurance in California, we collected statewide typical rates from 8 insurers: Mercury, Allstate, CSAA (AAA Neither, Cal), Farmers, Geico, Interinsurance Exchange (AAA So, Cal), State Ranch as well as United Auto Insurance Policy Co - coverage. (UAIC). All quotes are for minimal insurance coverage policies for a 30-year-old man who is legally needed to have his insurance company file an SR-22 on his part.

These rates were openly sourced from insurance company filings and also ought to be made use of for relative functions just your very own quotes may be various.

To obtain an SR-22 removed, a vehicle driver requires to call their insurance policy business when they are no longer needed to have the SR-22 on data with their state DMV. motor vehicle safety. While each state has its very own guidelines for the length of time drivers must preserve an SR-22, it can generally be eliminated after 3-5 years.

Not known Details About Cheap Sr-22 Insurance: What Is It? How Do You Get It?

The regular size of time is for 3 years but may be as numerous as 5. If a motorist is needed to preserve an SR22, the certification must suggest that the equivalent insurance coverage policy covers any cars and trucks that are signed up under the vehicle driver's name as well as all cars and trucks that the chauffeur consistently runs.

If that very same motorist, nevertheless, owns a vehicle or has regular access to a cars and truck, he would need to submit a non-owners SR22 certificate. sr22. This provides the chauffeur coverage whenever he is offered permission to drive a vehicle not his own. The expense of an SR22 ranges insurance firms.

Insurance policy firms that do offer SR22 coverage tend to do so at a high price. SR22 insurance coverage clients likewise unavoidably pay greater premiums for their minimal liability protection.

When first purchased to acquire an SR22, an individual will likely first call their current auto insurer. Once that happens, it, however, signals the company to the reality that a considerable occasion has happened. driver's license. The insurer will proceed to access the DMV document to check out why the vehicle driver requires the certificate.

If the policy is terminated, the chauffeur will certainly be forced to find an alternative alternative. A driver is not called for to get an SR22 from their current auto insurance coverage business.

The 15-Second Trick For How Much Does Sr22 Insurance Cost

Generally, a chauffeur is required to have an SR22 on file for three years after a license suspension as a result of DUI. The original certification will certainly stay on file with the DMV as long as either the vehicle insurance business or the chauffeur does not cancel the plan. There is no need to re-file yearly (insurance group).

After encountering apprehension, court days, and frustrating needs from the DMV, the last point they want to do is bargain with an insurance policy agent. Agencies are out there that can aid you discover the finest rates for SR22 insurance policy.

Insurance firms additionally consider just how numerous miles you drive as well as when you drive to identify your level of mishap risk. If you have a lengthy commute, your prices will certainly set you back greater than someone with a brief commute. If you drive during thrill hr, you have more threat than if you drive in the middle of the day. department of motor vehicles.

It turns out that where you live has a large effect on how much you pay for SR22 insurance policy. For beginners, where you live can make a huge impact on just how likely you are to submit a claim with your insurance firm.

Your state also has a big impact on your vehicle insurance policy prices. Each state is accountable for setting its very own needs for the minimal car insurance coverage that all motorists need to carry.

The smart Trick of Sr-22 Auto Insurance That Nobody is Talking About

Some states just require reasonably small restrictions, whereas various other states need much greater restrictions. Various other insurance coverage legislations also vary from one state to another (vehicle insurance). The majority of states utilize an at-fault system of vehicle insurance policy, where the vehicle driver that created the accident is accountable for the damages, but some states use a no-fault system.

All of these distinctions impact your vehicle insurance policy rates. We operate in all 50 states, and also we're connected with numerous insurance policy firms.

How to Save Money on SR22 Insurance coverage If you need SR22 insurance policy for the first time, you probably have a great deal of questions. This FAQ ought to clean up a couple of points for you. While the certain legislations differ in each state, several of the factors that an SR-22 may be mandated for a person are as follows: A chauffeur is convicted of driving without insurance coverage or with a policy that does not fulfill the state's minimum qualifications.

A driver has actually duplicated traffic offenses in a brief period of time. A motorist has actually had his/her driver's permit put on hold or withdrawed as well as desires to have it renewed. In some states, the suspension has to have been mandatory, which may be imposed for offenses such as reckless driving, driving under the impact (DUI) or driving while intoxicated (DWI). dui.

Certifications need to be filed with the DMV in the state that has actually mandated it or the driver""s current state of house. This might be completed by mail, however numerous states have applied digital filing systems. In enhancement, numerous companies will certainly file SR22s on behalf of policyholders, that makes the procedure really simple.

Sr-22 Insurance Illinois - Cheap Auto Insurance Chicago - Aai Things To Know Before You Buy

This fee may need to be paid straight to the state, however it might be possible to pay the charge via the insurer if they will certainly be submitting it. If the fee is paid by the firm, it might be included to the costs, however when purchasing SR22 insurance coverage estimates, it might not be included in the original quote - ignition interlock.

If the signed up proprietor of a lorry is picked for verification, evidence needs to be submitted within 6 months. credit score. If the evidence is not sent as well as if it does not satisfy the minimum requirements or if the owner's actual insurance coverage is different from that sent, a certification will need to be gotten.

Additionally, the brought in the brand-new state must meet the minimal obligation limits of the initial state - insure. Some insurance policy carriers do not offer declare various other states, so it is important to contact the carrier to talk about the information. Any kind of chauffeur who is needed to carry a certificate should constantly verify the details of the SR22 requirement with the DMV in the state mandating the insurance policy as well as with his/her company.

How to Start Conserving on SR22 Insurance Now You can begin saving money on SR22 insurance coverage right now without also leaving the comfort of your residence. The online quote process is basic. Enter your postal code. Select the year, make as well as design of your vehicle. Answer a couple of inquiries regarding yourself.

SR 22 Insurance There is a range of kinds of auto insurance policy that you are likely familiar with - from liability to extensive to crash - yet one kind you might not recognize is SR22 insurance policy. insure. SR22 insurance coverage is an accreditation of financial obligation and also is usually mandated by a court order complying with a conviction for a significant traffic offense.

The smart Trick of Sr-22 Insurance: Compare Quotes And Find Cheap Coverage That Nobody is Talking About

What is SR22 car insurance? Usually described as SR22 auto insurance policy, an SR22 is not actually insurance coverage, however rather a qualification of monetary duty sent to the Department (DMV) or Bureau of Motor Cars (BMV) on the policyholder's behalf (dui). It specifies that the policyholder has actually the mandated protection restrictions stated by a court order after a violation.

These infractions may consist of the following: - one of the most typical reasons for an SR22 required results from a driving under the impact conviction. This relates to those founded guilty of driving while intoxicated or under the impact of medicines that limit the vehicle driver's capability. - someone that is convicted of a significant traffic offense such as driving negligently or carelessly, typically over of 20 mph over the rate limit, may be needed to have SR22 cars and truck insurance coverage.

- if a chauffeur remains in a crash and also does not have insurance policy protection, the court might need them to have SR22 protection after the accident. - chauffeurs seeking reinstatement after having actually a withdrawed or put on hold license will typically be required to have SR22 auto insurance policy before they're granted permission to drive once more.