Having to file an SR-22 is nobody's suggestion of fun. You'll pay higher vehicle insurance coverage premiums than a driver with a tidy document as well as you'll be restricted in your option of insurance firms. Going shopping about for the cheapest rates can help. Here's what you require to recognize - no-fault insurance. See what you can save money on vehicle insurance coverage, Conveniently compare individualized rates to see just how much switching auto insurance might save you.

You might be called for to have an SR-22 if: You have actually been convicted of DUI, Drunk driving or an additional significant relocating offense. You have actually caused a crash while driving without insurance coverage.

For certain sentences in Florida and also Virginia, you might be gotten to file a comparable form called an FR-44. This calls for a higher degree of responsibility protection than the state's minimum. Not all states call for an SR-22 or FR-44. If you require one, you'll figure out from your state department of automobile or web traffic court.

When you're notified you need an SR-22, begin by calling your automobile insurance provider. Some insurers do not provide this service, so you might require to go shopping for a business that does. If you do not currently have vehicle insurance, you'll possibly need to purchase a plan in order to obtain your driving opportunities recovered - coverage.

Insurance quotes will certainly additionally differ depending on what cars and truck insurance coverage firm you select. See what you could save on automobile insurance coverage, Quickly compare individualized prices to see exactly how much switching vehicle insurance can save you.

The 9-Second Trick For Sr22 Insurance Dui: Everything You Need To Know - Car And ...

Location matters. As an instance, take into consideration a chauffeur with a current drunk driving, an infraction that could cause an SR-22 demand. Nerd, Purse's 2021 price evaluation found that out of the nation's 4 biggest firms that all submit an SR-22, insurance coverage rates usually were most inexpensive from Progressive for 40-year-old motorists with a current DUI.

In many states, an SR-22 demand lasts 3 years. If your plan gaps while you have an SR-22, your insurance company is required to notify the state as well as your license will certainly be put on hold. When your requirement finishes, the SR-22 does not immediately diminish your insurance plan. See to it to let your insurance firm know you no longer require it.

Fees usually stay high for 3 to 5 years after you've triggered an accident or had a moving offense. If you look around after the three- as well as five-year marks, you may discover reduced premiums (underinsured).

Which states need SR-22s? Each state has its own SR-22 insurance coverage demands for vehicle drivers, and also all go through change (department of motor vehicles). Connect with your insurance policy company to discover your state's current demands as well as see to it you have sufficient protection. Just how long do you require an SR-22? Most states need motorists to have an SR-22to show they have insurancefor regarding 3 years.

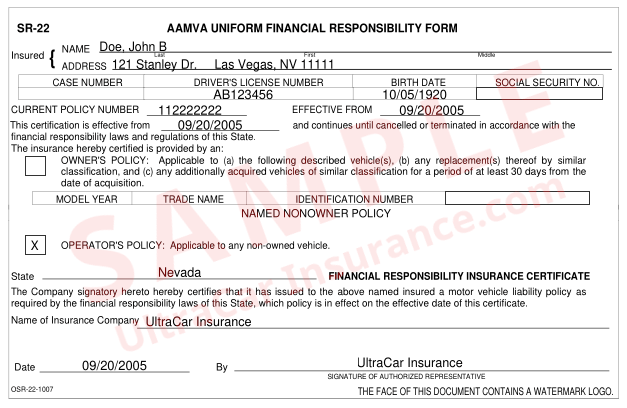

What is an SR-22? An SR-22 is a certification of economic duty needed for some chauffeurs by their state or court order. An SR-22 is not a real "type" of insurance policy, yet a kind filed with your state. This form offers as evidence your car insurance coverage plan meets the minimum obligation protection required by state law.

The Definitive Guide to Sr22 Insurance - File An Sr-22 Today

insurance group sr22 coverage auto insurance dui no-fault insurance

insurance group sr22 coverage auto insurance dui no-fault insurance

Do I require an SR-22/ FR-44?: DUI sentences Reckless driving Mishaps triggered by uninsured motorists If you require an SR-22/ FR-44, the courts or your state Electric motor Car Department will alert you.

Is there a fee associated with an SR-22/ FR-44? This is an one-time fee you should pay when we submit the SR-22/ FR-44.

A filing cost is billed for each and every private SR-22/ FR-44 we submit - credit score. As an example, if your spouse gets on your plan and both of you need an SR-22/ FR-44, after that the declaring cost will certainly be charged two times. Please note: The fee is not included in the rate quote since the declaring charge can vary.

For how long is the SR-22/ FR-44 valid? Your SR-22/ FR-44 should stand as long as your insurance coverage is active. If your insurance coverage plan is canceled while you're still required to bring an SR-22/ FR-44, we are required to inform the correct state authorities. If you don't preserve continuous insurance coverage you might shed your driving advantages.

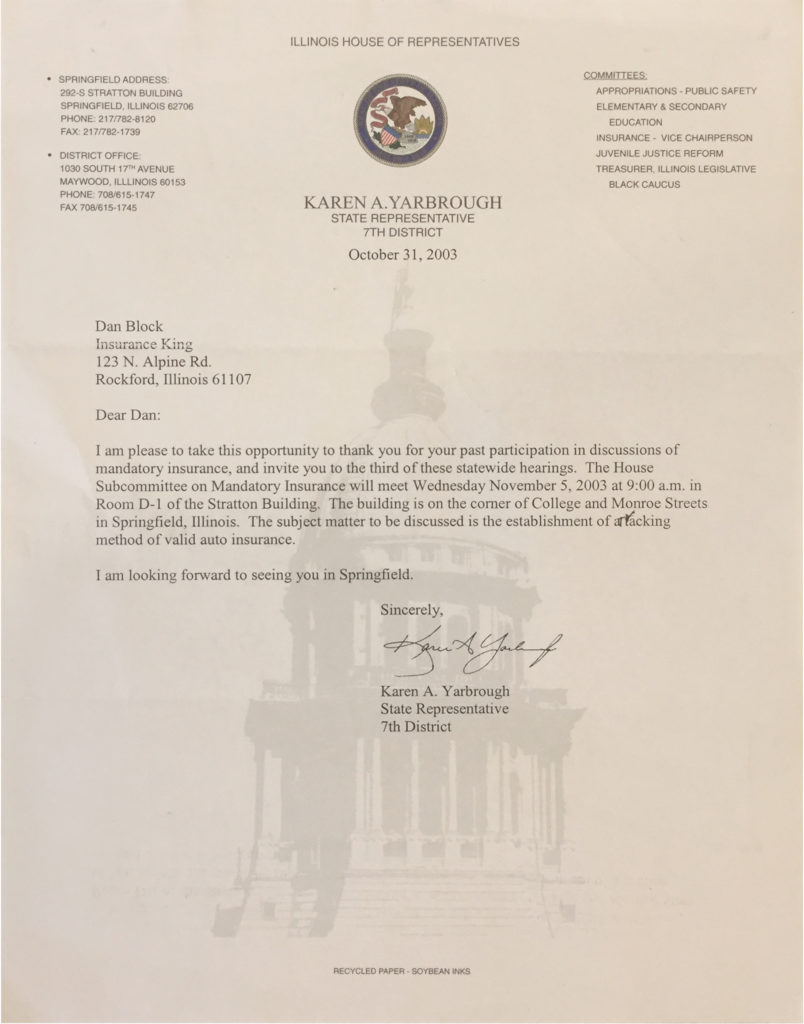

That "uh oh" minute. You have actually been informed you need this point called SR22 insurance policy. Don't worry, we obtained this. We're right here to help you - no-fault insurance. Problem-free filing. Genuine. There's no documentation. Call us for a totally free quote at ( 773) 202-5060 or you can get covered online in 2 minutes. We'll aid you get your SR22 On the Place. Obtained a letter from the State of Illinois to verify your coverage? No worry.

Not known Factual Statements About What Is Sr22 Insurance Virginia? - Kalfus & Nachman

Instant SR-22 Insurance Policy Filing If your certificate has been put on hold, withdrawed, or you've had a DUI, a might be needed to renew your driving benefits. With Insure on the Area, you can electronically file today!.? (sr-22 insurance).!! We'll care for it for you and conserve you cash. or Call ( 773) 202-5060 Need SR22? We Make It Easy! You have inquiries.

SR-22 insurance coverage!.?.!? To obtain a Chicago SR-22 insurance certification, you require a car insurance plan that satisfies the state's minimum obligation coverage. When you obtain a policy with Insure right away, a document is submitted to the state confirming that you have insurance coverage. If your permit has actually been suspended, withdrawed, or you are deemed a high risk scuba diver.

At mistake Mishaps, Depending on the intensity of a mishap, if you have actually been found responsible for an accident, you may additionally be ordered by the courts to preserve an SR-22 for a set time period. Several Infractions, Those that acquire several smaller sized traffic infractions in a brief time period may require to submit an SR22.

Just How Does SR-22 Insurance function? You may have concerns if your company is not accredited in the state requesting an SR-22 certification (insurance).

Living in a various state does not mean your SR-22 needs disappear. If your insurer is not certified in the state asking for the SR-22, you will certainly need to directly submit the SR-22 kind with that state's DMV.If the process is overwhelming, contact the state's Department of Motor Autos or your representative for assistance on your state's demands.

Indicators on Sr22 Insurance You Need To Know

SR22 Insurance Policy Prices, Just how much an SR-22 filing expenses varies by state. Motorist's typically pay around a $25 filing cost for declaring SR-22 insurance Click for more info policy. This can vary by state and also the insurance coverage provider. An SR-22 is fairly low-cost and also obtains connected to your pre-existing policy. insurance coverage. If you are gone down from your service provider or never ever had car insurance policy, you have some selections to make when it concerns discovering the most effective protection rates.

Fulfilling your state's needs need to be a priority, but you want to find a quote with a plan that is budget friendly. With nearly every company providing a quote online, your chances of finding fantastic protection at an also better price may enhance. Will an SR-22 plan affect my insurance policy cost? Yes.

Always be planned for greater coverage prices after the filing. How to Lower Automobile Insurance Coverage Fees After an SR-22 plan, Your auto insurance policy premiums are bound to increase adhering to an SR-22 need as well as you're going to want to discover a way to lower them. While they may never ever be as reduced as they were pre-SR-22, there are still some ways to make them match your budget plan better (car insurance).

liability insurance underinsured sr22 sr22 coverage division of motor vehicles

liability insurance underinsured sr22 sr22 coverage division of motor vehicles

division of motor vehicles sr22 insurance insurance coverage credit score

division of motor vehicles sr22 insurance insurance coverage credit score

The greater your deductible is, the less your insurance premiums will certainly be. It is important to keep in mind that when you establish your deductibles at a certain amount, you require to make certain that you can in fact pay it following a crash.

High-powered, luxury vehicles are a lot more expensive to guarantee than your day-to-day car. More recent designs additionally often tend to be much more pricey to cover than decades-old cars. It's useful to look around as well as sell your car for one that's a couple of years of ages with great security scores. You will show up to be less of an insurability risk to your insurance service provider.

Faqs About Sr22 Insurance In Az Fundamentals Explained

If you are still displeased with your insurance coverage costs, ask your insurance coverage representative about any type of discount rates you are qualified for - underinsured. Representatives are well educated of the basics of all type of price cuts you can receive. Terminating or Removing Your SR-22 Insurance Coverage, Also if you are particular your SR-22 period is up, calling your states Division of Electric motor Autos or DMV confirming that is an excellent concept.

Carrying only the state minimum protection will typically not suffice when you need an FR-44. This, in turn, will raise your vehicle insurance policy prices. An FR-44 certificate is required for three years usually, and it also can not be canceled before the expiry day. SR-22 Regularly Asked Questions, Are there various sorts of SR-22s? There are 3 choices when acquiring an SR-22 certification from your insurance firm, Owner, Operator, and also Owner-Operator (division of motor vehicles).

Operator - An Operator's SR22 Form is for vehicle drivers that obtain or lease an automobile rather of owning one - dui. This may also be matched with non-owner SR-22 insurance and can supply a less expensive alternative if it's tough covering the expense of an SR-22. Operator-Owner - The Operator-Owner's SR22 Kind is meant for chauffeurs who both own an automobile but periodically, rent or borrow one more cars and truck.

no-fault insurance dui auto insurance sr-22 insurance companies

no-fault insurance dui auto insurance sr-22 insurance companies

You additionally can not just acquire an SR-22 certificate. It goes together with your auto insurance plan. Just How Can I Find The Most Affordable SR22 Insurance Near Me? The very best means to discover low-cost SR22 insurance near you is by shopping about and also obtaining quotes. This is vital when you are obtaining any type of insurance plan but particularly essential for SR22s - department of motor vehicles.

National insurance policy business are not anxious to give insurance coverage for a person who needs SR22 insurance. You might have much better good luck with local firms as they commonly will cover risky motorists, which you will certainly be taken into consideration with your SR22 need. Make certain to obtain SR22 quotes from every insurance policy company you discover and analyze all the SR22 policies available on the market. driver's license.

Some Ideas on Sr-22 Insurance: What It Is And How To Get It – Forbes Advisor You Should Know

Does SR-22 Insurance Cover Any Car I Drive? Yes, your SR22 insurance policy will cover any auto you drive as long as you have owner-operator SR22 insurance policy - insurance. An owner-operator SR22 certificate is a sort of SR22 type that enables you to drive any kind of car, no matter who owns it, as well as still be identified as an insured chauffeur with a valid SR22.

bureau of motor vehicles credit score vehicle insurance credit score auto insurance

bureau of motor vehicles credit score vehicle insurance credit score auto insurance

Owner SR22 insurance is an SR22 type that just enables you to drive cars that you have. Non-owner SR22 insurance policy is the least expensive choice yet is only for individuals that do not have a lorry yet they regularly drive, whether it be from renting or borrowing somebody else's cars and truck. It depends on what your vehicle possession status is when it concerns whether your SR22 will certainly rollover to vehicles you drive.